CHAPTER 16

I approach the subject of ‘The Creature from Jekyll Island’ with a mix of fascination and scrutiny. The ‘Creature’ is a metaphor for the Federal Reserve, the central banking system of the United States. The term reflects the secretive and complex nature of its formation, a process which the book’s author G. Edward Griffin highlights as both enigmatic and contentious. The origins of this ‘Creature’ extend far beyond the geographical confines of Jekyll Island, where a group of elite bankers and politicians convened in 1910 to reshape the nation’s financial system. This meeting is critical to the Creature’s journey to America; the decisions made there would ripple through time, establishing a banking cartel.

The pivotal moments that brought the Creature to America are not merely a series of dry historical events; they signify a transformative period in U.S. economic history. Chapter 16 of Griffin’s book dives into the tumultuous climate of the early 20th century, an era of industrial magnates and vast economic change. The establishment of the Federal Reserve was an answer to financial panics, specifically the Panic of 1907, and the urgent call for a centralized banking structure. This Creature, with its power to regulate the monetary system and influence currency, represented a seismic shift for American finance.

In the broader historical context, my analysis of Chapter 16 exposes the intricacies of how the Creature’s journey interplayed with the American Dream. It’s a tale of ambition and control, where economic stability was sought at the expense of autonomy. The Creature’s introduction to America’s financial systems redefined not just monetary policy but also the economic lives of American citizens in tangible ways. This development planted seeds of both growth and tumult for decades to come.

The impact of the Creature’s arrival on American financial systems remains a subject of debate among economists, historians, and finance professionals. It brought about the centralization of financial power, creating a monolith capable of influencing inflation, unemployment, and international trade. However, the long-term effects of its pervasive control and the moral dilemmas it poses are critical to understanding the Creature’s true legacy. As we delve into the next section, we’ll dissect the Creature’s power and influence, unraveling the complex relationships that have shaped the nation’s financial foundations.

Decoding the Creature: Understanding Its Power and Influence

The term ‘Creature’ refers to the Federal Reserve System, and its power and influence are undeniable. Established in 1913, the Creature’s intentional veil of complexity often cloaks its true impact on everyday Americans. Chapter 16 of the book ‘The Creature from Jekyll Island’ exposes the intricate crafting of this financial institution and its extensive reach into the economic fabric of the nation.

At the core, the Federal Reserve was a consequence of a convergence between banking interests and political maneuvering. The historical facts surrounding its formation reveal a calculated effort by a group of influential bankers who, under the guise of a duck hunting trip on Jekyll Island, devised a plan to centralize control over the nation’s money supply.

This convergence was not just about creating stability in times of economic panic but also about consolidating power. The Federal Reserve’s control over interest rates and banks’ emergency funding essentially gave it the ability to influence the entire economy. It’s no stretch to say that the Creature has, since its inception, played a pivotal role in shaping the booms and busts that have characterized the American economy.

The repercussions of this centralized control are far-reaching. The Creature’s presence has, in many ways, created a cushion for financial institutions, but questions linger about its role in income inequality and its contribution to long-term debt cycles. The impact of the Creature on American society extends beyond economics, prompting debates on financial ethics and the role of government in a capitalist society.

Understanding the Creature’s influence is KEY for anyone looking to grasp the undercurrents of the American financial system. It sheds light on why and how economic decisions are made and who ultimately benefits or suffers from these decisions. As you follow me into the final section, the narrative takes a turn towards examining the Creature’s lasting legacy and its role in shaping modern America.

The Creature’s Legacy: Shaping Modern America

The Creature’s role did not end with the strokes of a pen that established the Federal Reserve. Its legacy continued to expand, shaping the monetary policy and economic framework of the nation. Over a century has passed, and the Creature’s influence remains deeply embedded within the very fabric of America’s financial system.

The decisions and structures birthed from the Creature’s conception now touch almost every aspect of American life. From the Great Depression to the 2008 financial crisis, the Creature’s DNA can be traced through the major economic events in U.S. history. This lineage prompts us to question how the Creature’s past actions cast long shadows on the present.

Today’s debates around monetary policy, bank regulations, and economic stability are in some ways echoes of the Creature’s original design. Critics and proponents alike draw lines connecting current financial challenges back to the systemic foundations laid down over a century ago. These discussions often revolve around the balance of power, the role of oversight, and the pursuit of financial equity and stability.

The Creature from Jekyll Island, once a veiled enigma, has now become a symbol of the penetrating power of central banking in a modern world. It’s essential to study and understand this Creature not as a myth, but as a reality—a reality that has, and will continue to, influence the well-being of millions.

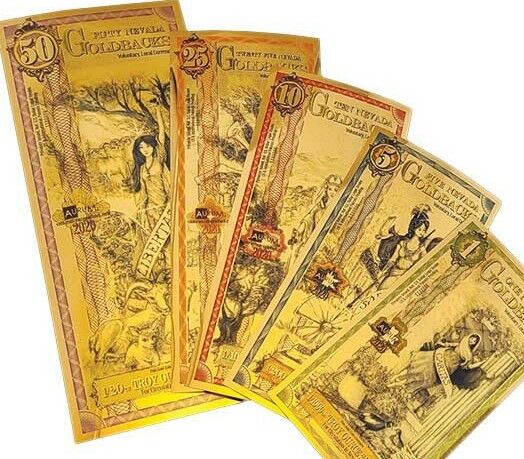

Moving forward, the key question remains: How can America adapt the Creature’s legacy to serve the public interest in today’s rapidly changing economic landscape? Recognizing past missteps but also embracing innovation, we can pave a way forward. Get back on a Gold Standard. Forging policies that draw from historical lessons, the goal is to safeguard against past vulnerabilities while promoting growth, inclusivity, and stability for all. We suggest saving in precious metals. Goldbacks are affordable way of protecting what you work hard for over the years. We wish ever state would start creating their own Goldbacks. Currently Goldbacks are in only 5 states New Hampshire, Utah, South Dakota, Nevada, and Wyoming, and is not legal tender for the government but it can be for the people just like they say Bitcoin is. For those of us who still like the feel of cash……. just in the gold form. Get You Weight Up, Real money is weighed not counted. Get some Gold Backs click the link below.

Chapter 15 The Lost Treasure Map

Chapter 17 A Den Of Vipers

What a compelling and insightful article! You’ve tackled a complex and often misunderstood subject with clarity and depth, making the intricate history and impact of the Federal Reserve accessible and engaging.

Your exploration of the Federal Reserve as the ‘Creature’ from Jekyll Island is fascinating. The historical context you provided, especially the secretive meeting in 1910, paints a vivid picture of how significant this event was in shaping America’s financial landscape. It’s intriguing to think about how these early 20th-century decisions continue to influence our economy today.

Your article is a thorough and unique take on a subject that often feels shrouded in mystery. It not only educates but also encourages readers to think critically about the role of the Federal Reserve and the potential for alternative, sustainable economic practices.

Thanks for shedding light on this important topic. Keep up the great work!

Thank you Kavitha for thoughtful comment. It is our mission to educate and inform the public on our financial system and ways to reform our current system where only a few benefit to a system that is beneficial to all.