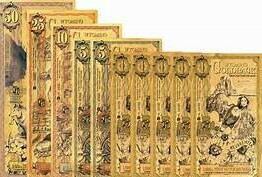

Goldbacks offer a refreshing twist as an alternative currency. Unlike traditional money, each Goldback bill contains a small amount of actual gold. This tangible value attracts many who are cautious about the stability of regular currency.

The benefits of using Goldbacks can be quite appealing. Since they’re made of gold, they hold intrinsic value. This tends to protect against inflation and offers a sense of security. Moreover, they are easy to carry and use in everyday transactions, just like regular cash.

Goldbacks are created through an intricate process where gold is atomically bonded between layers of durable polymer. These layers protect the gold, ensuring the bill remains usable over time. The amount of gold corresponds to the denomination, making it straightforward to understand and use.

When comparing Goldbacks to cryptocurrencies, there are significant differences. Cryptocurrencies rely on blockchain technology and hold no physical value. Goldbacks, on the other hand, are a physical representation of wealth, providing a tangible sense of security. They don’t require digital wallets or understanding of complex tech, which can make them more accessible to a broader audience.

Different states have already started recognizing the value of Goldbacks. For instance, Utah, New Hampshire, and Wyoming are leading examples where you can see Goldbacks in action. From local businesses to larger transactions, the practicality of using Goldbacks is becoming more evident.

The Constitutional Basis for State-Made Currency

Article I, Section 10 of the U.S. Constitution is clear: “No State shall… make any Thing but gold and silver Coin a Tender in Payment of Debts.” This foundational rule underscores the idea that states have the authority to create currency rooted in gold and silver. It’s a powerful directive emphasizing that hard money, such as Goldbacks, aligns perfectly with what the Constitution envisions.

Historically, gold and silver were the go-to forms of money. They provided stability and trust, something paper money often struggles with. When the Founding Fathers drafted the Constitution, they prioritized these metals, seeing them as reliable benchmarks of value.

States, not private entities, should take the lead in producing currency. The Constitution supports this by pointing out that monetary power shouldn’t be in the hands of private institutions. A state-controlled approach ensures transparency, accountability, and adherence to public interest, unlike private companies, which may prioritize profit.

The Federal Reserve plays a massive role in today’s monetary system. However, it’s a private entity with significant control over money supply and monetary policy—a fact that often flies under the radar. Shifting focus to state-based currencies like Goldbacks can dilute this concentrated power, making the financial system more balanced and state-focused.

There are legal precedents where the court has sided with state sovereignty in monetary matters. These cases bolster the argument that states can introduce and maintain their currency systems. While challenges exist, the legal framework provides a viable path for states keen on adopting alternatives to the Federal Reserve-controlled currency.

Implementing Goldbacks in Every State

Introducing Goldbacks across various states requires clear steps. First, states need to pass legislation recognizing Goldbacks as legal tender. This move ensures that businesses and individuals can use them confidently for their transactions.

Legislative action is crucial. State lawmakers must draft and pass bills that align with the constitutional provision of gold and silver as money. Collaboration between policymakers, economists, and legal experts will ensure the legislation is well-rounded and robust.

Challenges will arise. Concerns about counterfeiting, acceptance, and logistical hurdles are common. However, these can be mitigated with proper planning and public education. Educating people about the value and security of Goldbacks is key to gaining widespread acceptance.

Public acceptance hinges on awareness and understanding. States can launch educational campaigns to inform citizens about how Goldbacks work and why they’re beneficial. Workshops, seminars, and informational resources can help demystify the concept for the general public.

Businesses play a vital role in this transition. Encouraging local businesses to accept Goldbacks can spur wider adoption. Some states have successfully piloted programs where businesses accept Goldbacks alongside traditional currencies, paving the way for broader acceptance.

Looking ahead, the growth potential for Goldbacks is promising. As more states adopt this currency, a network effect will likely occur, making Goldbacks more viable and valuable. This creates a resilient, state-supported monetary system that’s less dependent on federal oversight.